Depreciation on Office Equipment Manufacturing Overhead

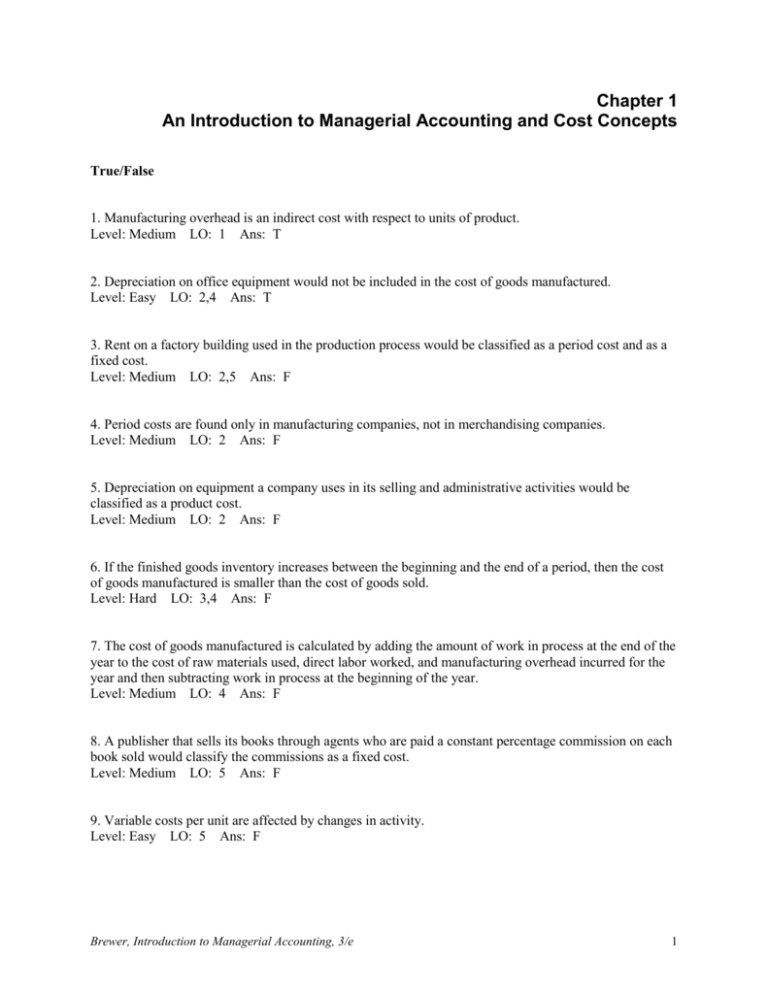

Depreciation on Flat Rock Michigan assembly plant c. Repairs to office equipment are period costs.

Prime Costs Conversion Costs Bom And Gp In Manufacturing Brandalyzer

Dividends paid to shareholders d.

. Debits Depreciation expense while the other debits Manufacturing overhead. How these costs are assigned to products has an impact on the measurement of an individual products profitability. Definition of Depreciation Expense.

When an industrial manufacturer records depreciation on office equipment used the corporate office they debit and credit Depreciation Expense Accumulated Depreciation Depreciation Expense Manufacturing Overhead Manufacturing Overhead Accumulated Depreciation Manufacturing Overhead Work In Process Inventory. Plant managers salary at Buffalo New York stamping plant which manufactures auto and truck subassemblies b. The difference between the entries to record depreciation on office equipment and depreciation on factory equipment is that one _____.

Petitioner is a New York corporation primarily engaged in the production of office equipment most notably copiers. Rent on the factory building. -estimated 12 comma 000 machine hours and 93 comma 000 of manufacturing overhead costs.

Equipment is eligible for the investment tax credit under section 21012 of the Tax Law. Petitioner sometimes subcontracts the production of certain. Similarly is Office Depreciation a product cost.

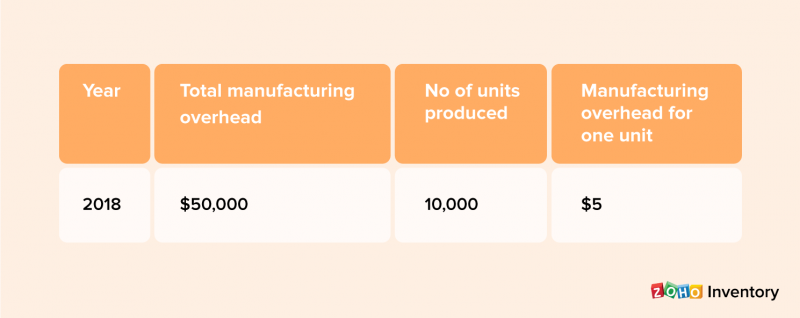

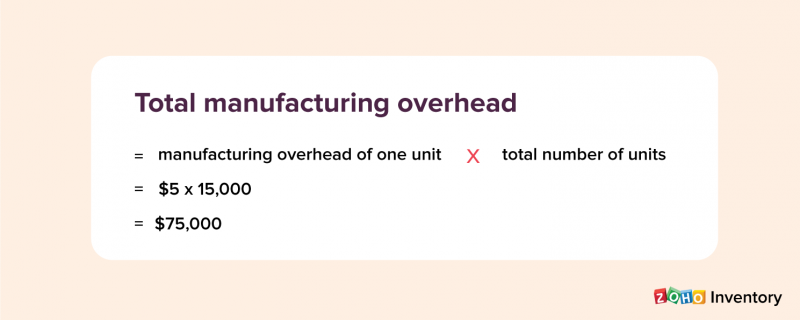

Click to see full answer. This overhead is applied to the units produced within a reporting period. Moreover is equipment depreciation a period cost.

For double-declining depreciation though your formula is 2 x straight-line depreciation rate x Book value of the asset at the beginning of the year. When an industrial manufacturer records depreciation on office equipment used in the corporate office they debit _____ and credit _____. In June Job 461 was completed.

Part of Factory Overhead. Depreciation expense manufacturing overhead Depreciation expense accumulated depreciation Manufacturing overhead accumulated depreciation Manufacturing overhead work in process inventory The relevant. Debit Depreciation expense and credit Accumulated depreciation.

-actually used 16 comma 000 machine hours and incurred the following actual costs. If the annual depreciation on the equipment in the Finishing Departments is 60000 a year the 60000 is a direct cost of the Finishing Department. The depreciation of office equipment would be classified as.

It is an indirect cost because the company has to allocate the depreciation to the three versions of the product line that are processed in the. When preparing financial statements in a job-order costing system finished goods flow first to the _____ and then to the _____. Here that is 20000 out of 200000 or 10.

The treatment of depreciation as an indirect cost is the most common treatment within a business. Salaries of manufacturing managers. Depreciation on administrative offices equipment is a product cost.

Assume that Gell. The predetermined overhead rate is 775 per machine hour. Manufacturing overhead termed as factory overhead.

Machine lubricant used to maintain the assembly line at the Louisville Kentucky assembly plant e. That is the cost of the repairs to office equipment will be reported as a selling general and administrative SGA expense in the period in which the repairs take place. Customer service Supply D.

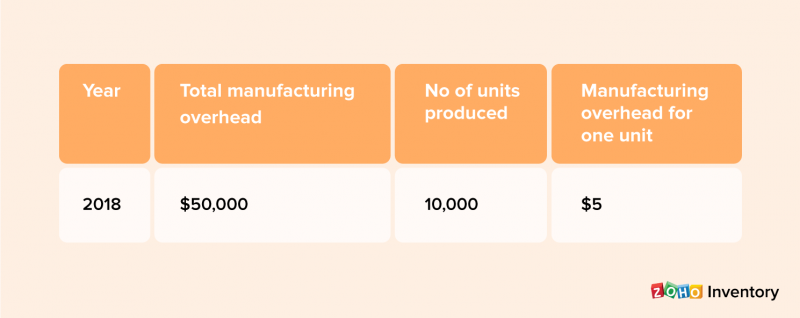

Repairs to factory equipment are not period costs. Depreciation on production equipment is a manufacturing cost but depreciation on the warehouse in which products are stored after being manufactured is a period cost. Factory overhead includes indirect materials such as cost of nails thread glue etc.

These costs relate to the factory where production is taking place. The journal entry to record depreciation on office equipment would. Depreciation on equipment used in the production process.

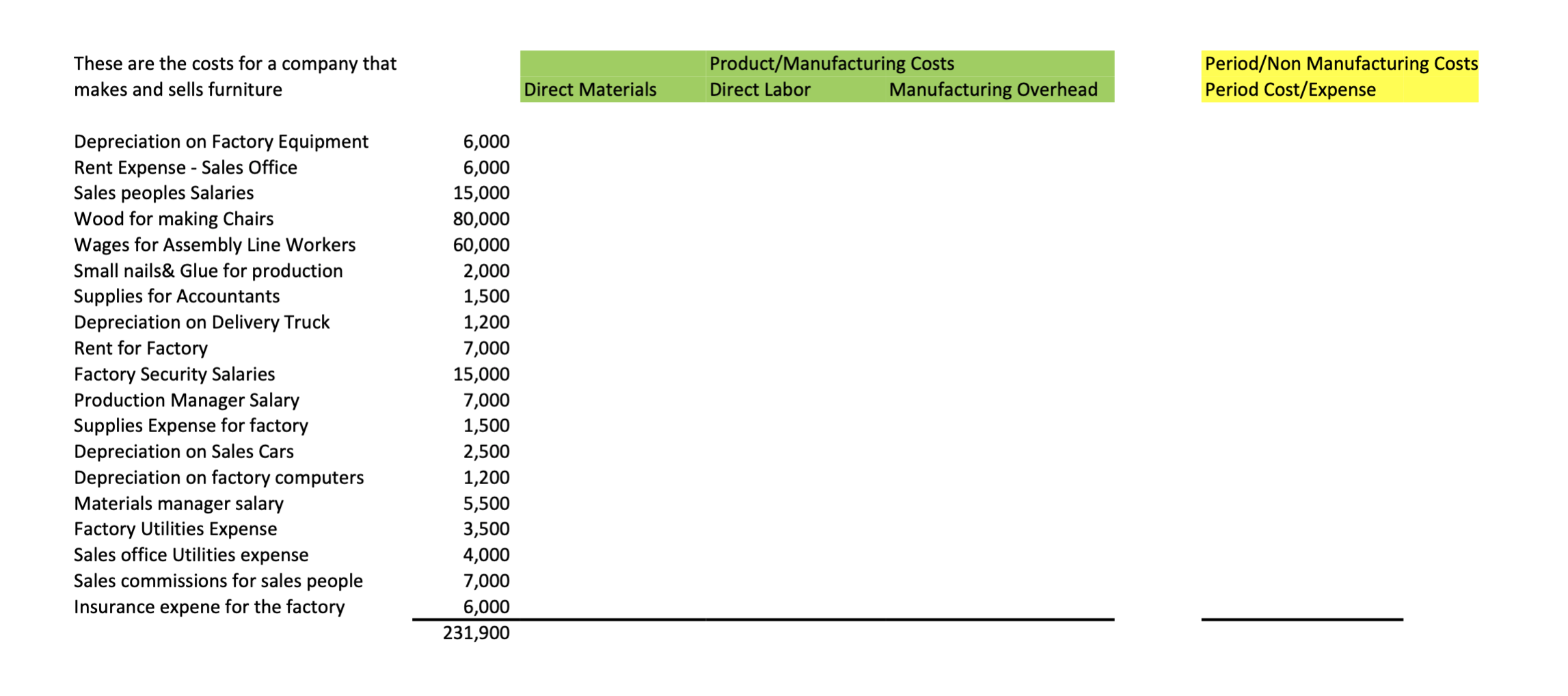

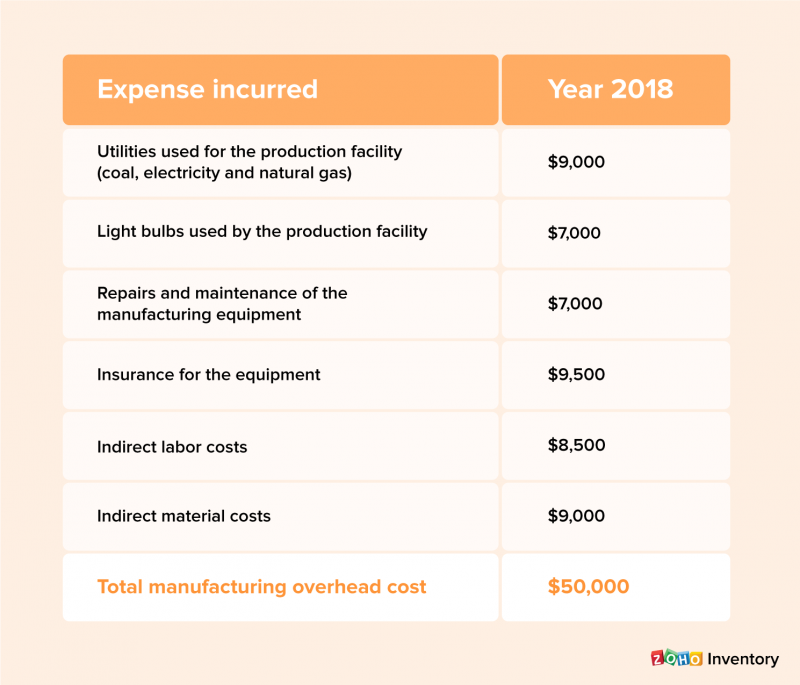

The depreciation of the equipment is also an indirect cost of the products using the equipment. There are two types of overhead. Manufacturing overhead includes such things as the electricity used to operate the factory equipment depreciation on the factory equipment and building factory supplies and factory personnel other than direct labor.

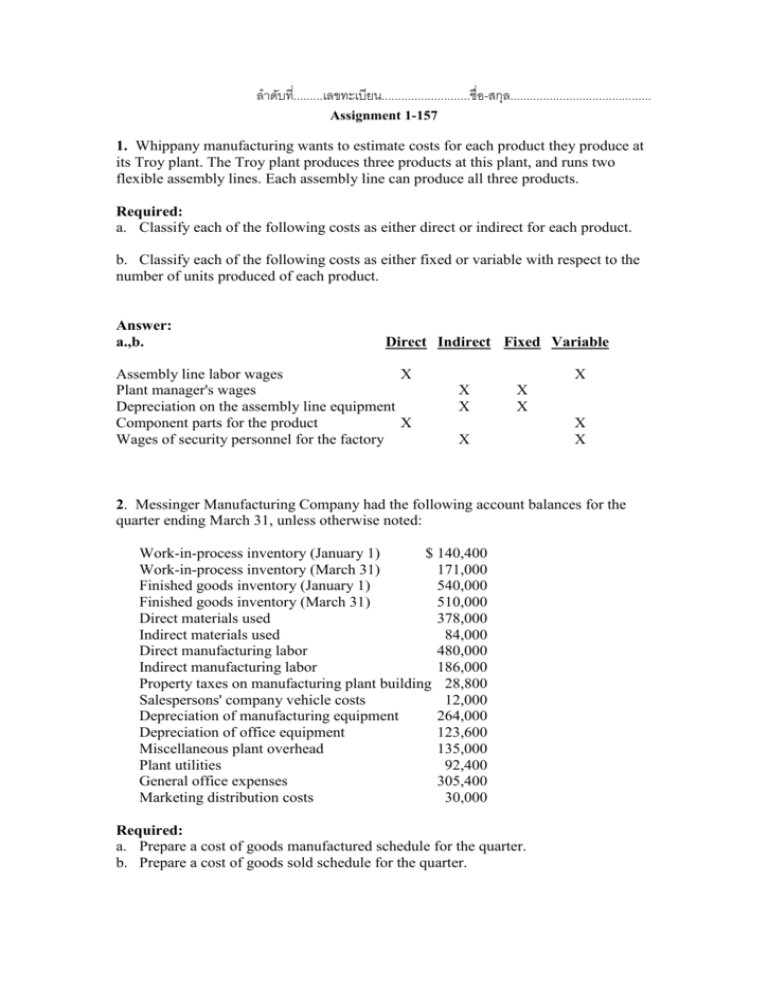

Petitioner submits the following facts as the basis for this Advisory Opinion. Property taxes on manufacturing plant building 28800 Salespersons company vehicle costs 12000 Depreciation of manufacturing equipment 264000 Depreciation of office equipment 123600. Last year manufacturing overhead and direct labor-hours were estimated at P50000 and 20000 hours respectively for the year.

Leather to be used on vehicles that. Rather the costs of repairs to factory equipment are product costs. Examples of product costs are direct materials direct.

Depreciation expense is the systematic allocation of a depreciable assets cost to the accounting periods in which the asset is being used. Property taxes on the production facility. Is depreciation expense an administrative expense.

Direct material costs are generally fixed costs. Indirect labor such as salary of the supervisor. Manufacturing overhead can be a variable cost or a fixed cost but not both.

Factory overhead - also called manufacturing overhead refers to all costs other than direct materials and direct labor spent in the production of finished goods. Downstream costs for a manufacturing firm consist of. Definition of Accumulated Depreciation.

The depreciation of assets used in the manufacturing process are considered to be a product cost and will be allocated or assigned to the goods. Accumulated depreciation is the total amount of a plant assets cost that has been allocated to depreciation expense or to manufacturing overhead since the asset was put into service. Parker Company uses a job order cost system and applies manufacturing Medium overhead to jobs using a predetermined overhead rate based on direct labor-hours.

Manufacturing overhead includes expenses as the electricity used to operate the factory equipment depreciation on the factory equipment and building cost of security guard personnel. -allocates manufacturing overhead based on machine hours. Miscellaneous plant overhead 135000 Plant utilities 92400 General office expenses 305400 Marketing distribution costs 30000.

The straight line depreciation rate is the percentage of the assets cost minus salvage value that you are paying. Estimate the total manufacturing overhead for the upcoming period. And factory expenses such as rent of the factory space depreciation of factory.

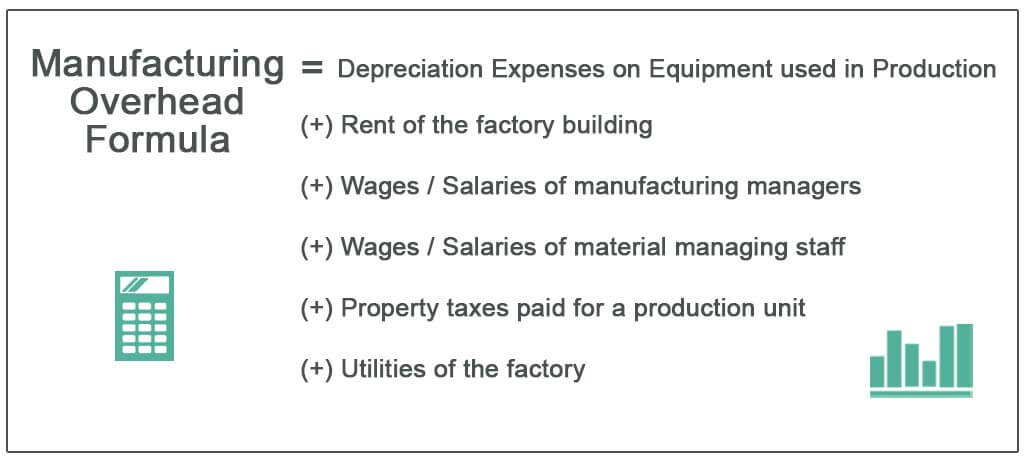

The difference between the entries to record depreciation on office equipment and depreciation on factory equipment is that one debits depreciation expense while the other debuts manufacturing overhead. Examples of costs that are included in the manufacturing overhead category are as follows. Salaries of maintenance personnel.

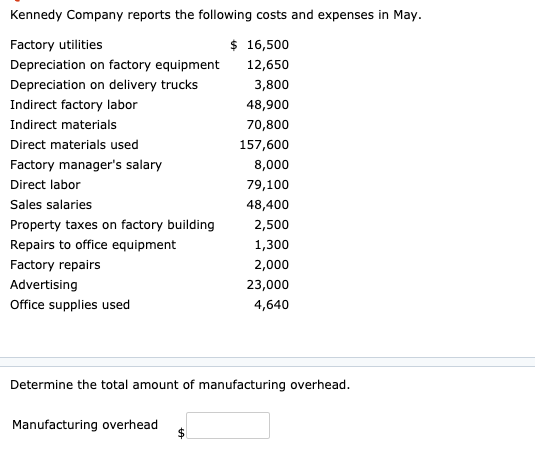

Depreciation on factory equipment Indirect factory labor indirect materials factory managers salary property taxes on factory building factory repairs _____ Sum them all up Manufacturing Overhead 179980. In the production department of a manufacturing company depreciation expense is considered an indirect cost since it is included in factory overhead and then allocated to the units manufactured during a reporting period. Accumulated depreciation and the related depreciation expense are associated with constructed assets such as buildings machinery office.

Profit And Loss Statement Template Doc Pdf Page 1 Of 1 Dv6bnftx Profit And Loss Statement Statement Template Income Statement

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Online Printers For Graphic Design Projects Retail Business Ideas Cost Of Goods Sold Business Blog

Solved These Are The Costs For A Company That Makes And Chegg Com

Manufacturing Overhead Cost Explanation And How To Lower Them

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Exercise 1 2 Presented Below Is A List Of Costs And Expenses Usually Incurred By Barnum Corporation Homeworklib

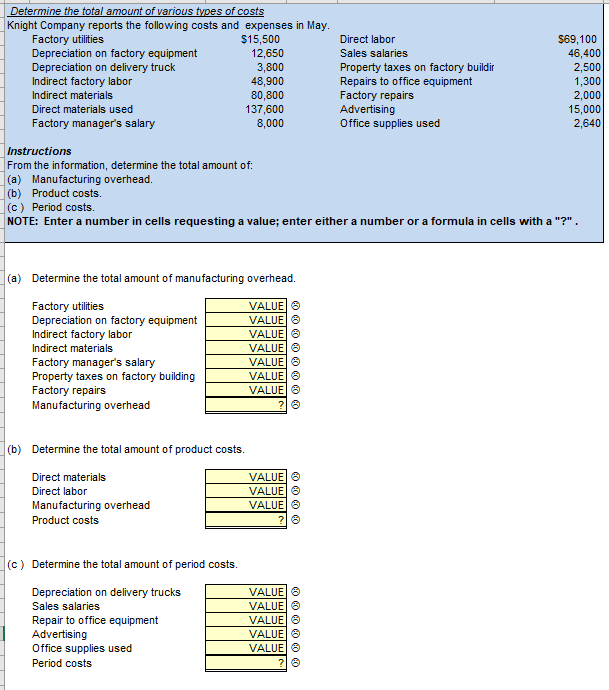

A Determine The Total Amount Of Manufacturing Overhead B Knight Company Reports The Following Costs Homeworklib

Is Equipment Maintenance A Product Cost Bikehike

Solved Data Table Costs Incurred Purchases Of Direct Chegg Com

Manufacturing Overhead Formula Step By Step Calculation

Solved Kennedy Company Reports The Following Costs And Chegg Com

Solved Determine The Total Amount Of Various Types Of Costs Chegg Com

A Determine The Total Amount Of Manufacturing Overhead B Knight Company Reports The Following Costs Homeworklib

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Limited Liability Companies Statement Of Financial Position Financial Position Limited Liability Company Financial

Comments

Post a Comment